Fort Reports

Financial performance metrics and quarterly results. Access detailed reports on FORT’s investment returns and fiscal health indicators.

Fort Reports

AGA Ordinara Anuala 2025

Raport anual 2024

Teleconferinta - prezentare rezultate financiare anuale

Rezultate financiare trimestrul I 2025

Rezultate financiare semestriale 2025

Teleconferinta - prezentare rezultate financiare semestrul I

Rezultate financiare trimestrul III 2025

AGA 18.12.2025

Voting form Shareholders legal entities for the Ordinary General Meeting of Shareholders (OGMS ) FORT S.A.

Formular de vot actionari persoane juridice pentru Adunarea Generala Ordinara a Actionarilor (AGOA) FORT S.A.

Convening notice regarding the ordinary general meetings of Shareholders of Fort S.A.

List of proposed candidates to fill in the vacant position as member in the Board of Directors of Fort S.A. to be voted in the Ordinary General Meeting of Shareholders (OGMS)

Ordinary General Meeting of Shareholders (OGMS) and Extraordinary General Meeting of Shareholders (EGMS)

Capital Increase with Free Shares

Convener of the Ordinary and Extraordinary General Meeting of Shareholders

Quarterly Report Q3 2025

Raport Trimestrial Trimestrul 3 2025

Current report no. 03 / 2026

Raport curent no. 03 / 2026

Current report no. 32 / 2025

Raport curent nr. 32 / 2025

Current report no. 31 / 2025

Raport curent nr. 31 / 2025

Current report no. 30 / 2025

Raport curent nr. 30 / 2025

Current report no. 21 / 2025

Raport curent nr. 21 / 2025

Capital Increase with Free Shares

Current report no. 07 / 2024

Shareholder information document regarding the offer or allocation of free shares

Financial results

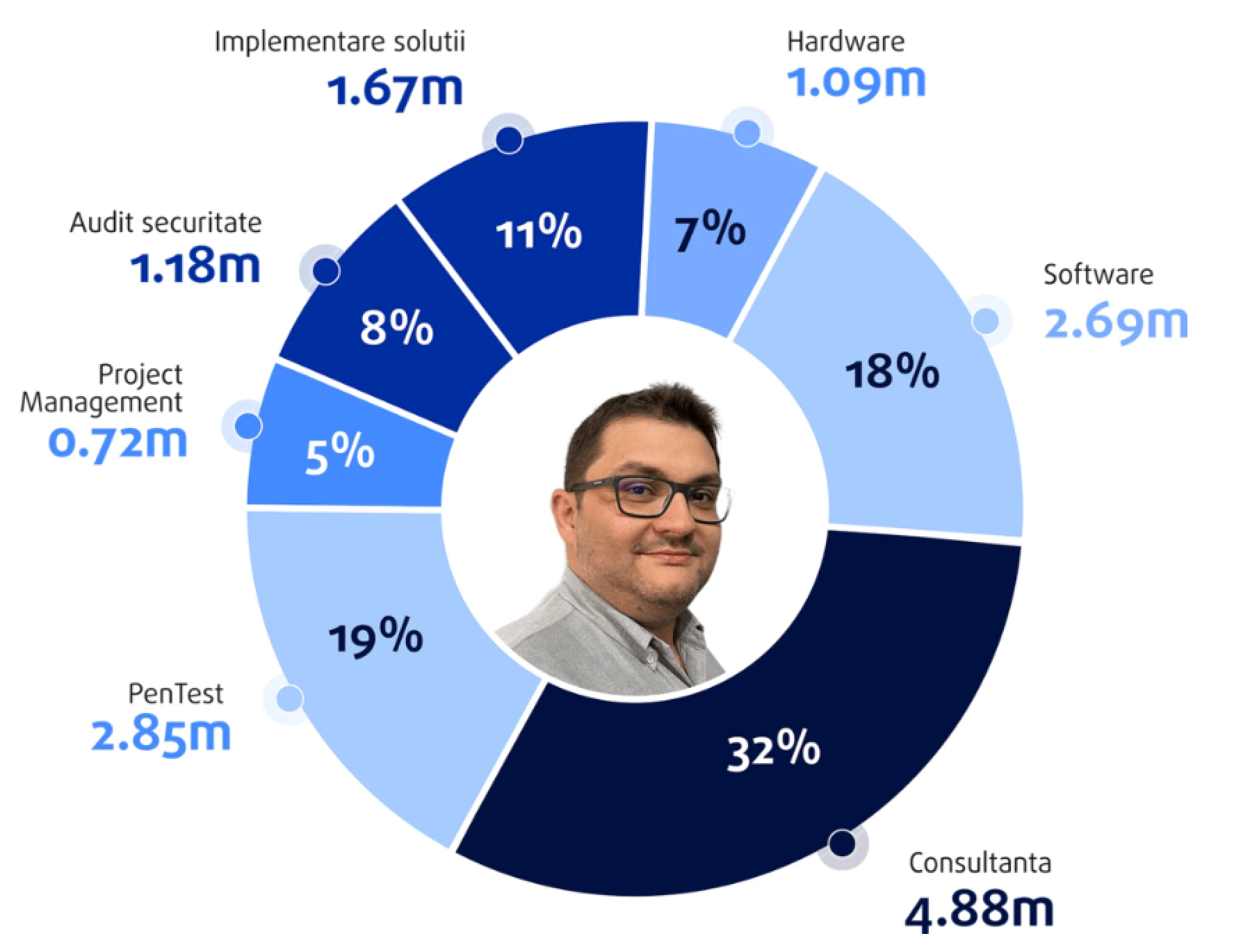

Swipe left to see the numbers |

2021 |

2022 |

YoY |

|---|---|---|---|

| Income from contracts with customers | 10,491,822 |

15,048,523 |

43% |

| Cost of sales | -5,375,089 |

-9,305,767 |

73% |

| Gross margin | 5,116,733 |

5,742,756 |

12% |

| Other incomes | 815,713 |

570,052 |

-30% |

| Cost of sales/distribution | -42,588 |

-339,971 |

698% |

| Administrative expenses | -1,808,449 |

-2,145,012 |

19% |

| of which amortization | -231,465 |

-253,454 |

10% |

| EBIT | 4,081,409 |

3,827,825 |

-6% |

| One-off results | 680,030 |

-151,175 |

-122% |

| Operating profit (without one-offs) | 3,401,379 |

3,979,000 |

17% |

| SOP expense | 0 |

0 |

— |

| Financial income | 5,882 |

182,236 |

2998% |

| Financial expenses | -32,136 |

-194,005 |

504% |

| Financial result | -26,254 |

-11,769 |

-55% |

| Mark to market revaluations | 0 |

0 |

— |

| Gross profit | 4,055,155 |

3,816,056 |

-6% |

| Income tax | -136,862 |

-195,441 |

43% |

| Net profit, of which | 3,918,293 |

3,620,615 |

-8% |

Letter from the CEO

2022 was a year of growth for FORT on all levels, foreshadowing our further development:

- 43% increase in business (up to 15 million RON)

- 17% increase in operating profit (up to 3.98 million RON)

- 20% team growth – 6 new colleagues joined us in 2022

- Diversification of revenue sources by starting a non-reimbursable funded project, which will result in the launch of an A.I. solution for the insurance and automotive industry.

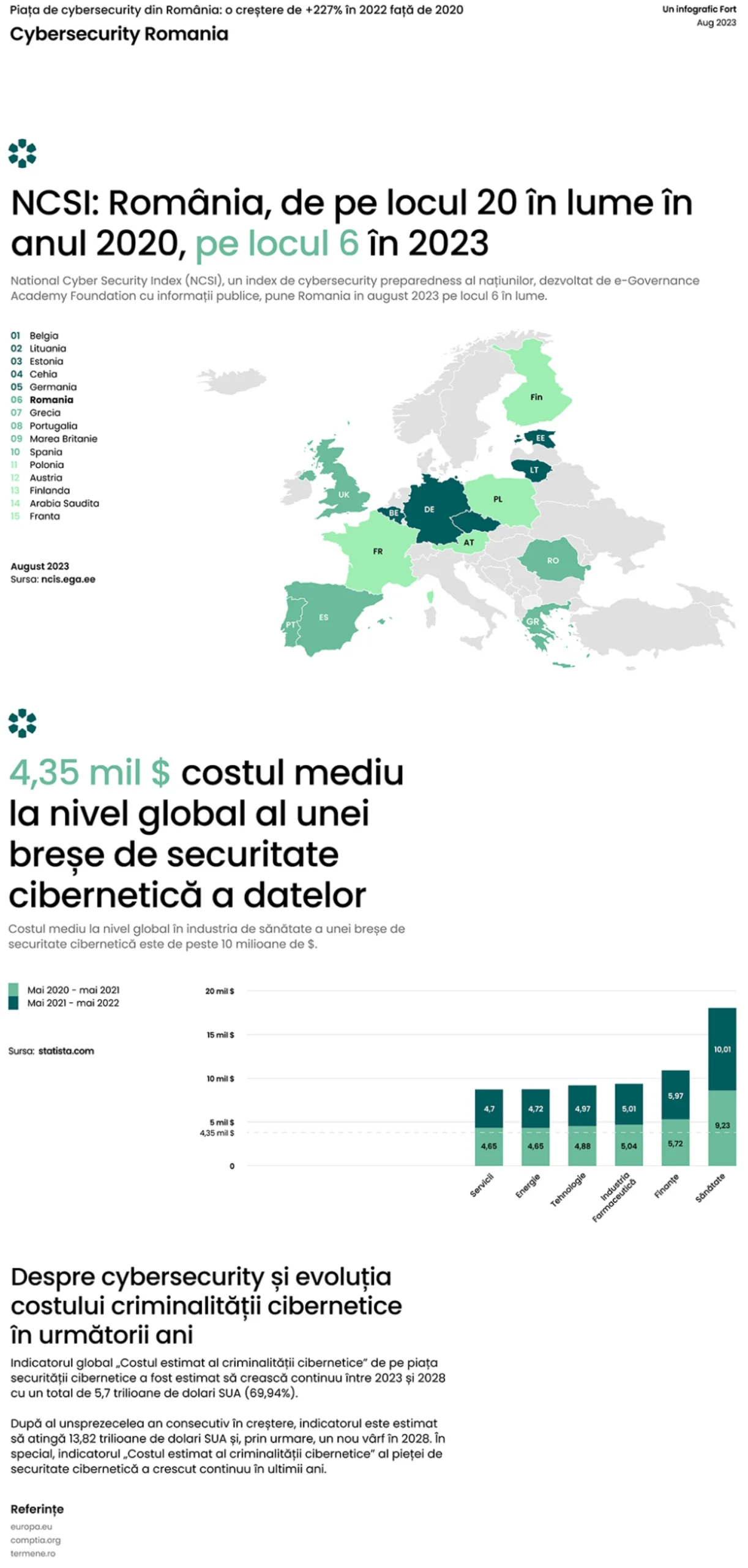

Cybersecurity has been and continues to be an area of great interest worldwide, with great potential for development in the coming period. This is largely due to the increasing volume of threats faced by companies in all sectors.

It is estimated that by 2025 losses from cybercrime will reach $10.5 trillion, while the average cost of a single data breach event is around $4.35 million. This will lead to a global market for cybersecurity services of around $188 billion by 2023.

We aim to make use of this favourable context by meeting the unaddressed needs of our clients, with a view to identifying, understanding and remedying possible security gaps. Throughout 2022 we have seen a continued demand for our services, a trend we expect to continue in 2023, especially given the continued diversification of attacks and the increasing level of sophistication they have in the cyber space.

We believe that the potential for increasing the need for cybersecurity in Romania consistently exceeds the enormous potential for increasing the degree of digitization. Any digital interaction and the migration of as many services as possible into the digital realm implicitly increases the need for advice and protection against increasingly frequent cyber attacks. In addition, legislative changes are forcing public interest companies to conduct regular security audits, which is increasing the recurring business volume for cybersecurity companies like Fort.

The current business is focused on services that are delivered by the company’s experts. As a consequence, recruitment, training and retention of employees have been and still are points of utmost importance for FORT’s development and profitability.

The previous year was very prolific in terms of team consolidation, with the number of permanent employees increasing by about 20%, with 6 colleagues joining FORT. By comparison, in 2020 and 2021 the recruitment activity managed to attract at most 3 new employees each year.

The growth of the team allows to expand the number of projects delivered, increasing also the confidence of the staff in the company’s development direction. This can be seen even in 2022: we delivered a considerably higher number of projects than in the previous year. Our colleagues worked more than 60,000 hours for the safety of our customers: +50% security audit projects compared to 2021, and +35% security consulting projects.

On the other hand, there continues to be a need for recruitment, specialisation and retention of cyber security experts. Globally, it is estimated that there are around 3.5 million unfilled positions available to be addressed in 2023. This situation is also true for Fort, with the company’s growth being more of a challenge from a delivery team perspective and less of a challenge in terms of identifying and capitalizing on new sales opportunities.

In order to ensure an adequate level in terms of teams, the company has increased in 2022, but mainly in the second half of the year, its recruitment mechanisms, using in this regard collaborations with 5 “headhunting” and “talent scouting” service providers. The expenses generated by these activities, reflected in recruitment costs and in the increase of the payroll fund, amounted to 685,000 RON, an investment that is expected, for the most part, to yield results in the first half of the new fiscal year 2023.

The year 2022 marked a first for the company, generated by the start of the execution of a project co-financed by European Funds, through which an innovative solution based on artificial intelligence will be delivered. The value of the entire project is 7.34 million RON, of which the European funding represents 5.74 million RON. Compared to the total revenue in 2022, the grant funding represents about one third of the annual turnover – in other words we could not develop this project with our own resources.

In return, the project deliverables will be Fort’s intellectual property and represent the culmination of over 8 years of experience in the insurance industry, primarily in terms of instrumentation of the motor claims analysis and settlement process. The solution will provide users with the ability to automatically identify damaged elements of a vehicle and make predictions on the estimated cost of repair.

Although cybersecurity is only a tangible component of the project, Fort’s involvement was made possible thanks to the company’s long-standing collaborations in insurance and the know-how the project team has in the areas necessary for the research approach.

During 2022, the existence of the project affected the company’s profit by approximately 150,000 RON. For 2023 the financial impact of the project will be about 850,000 RON. However, as a result of the project, regular revenues of at least 250,000 RON per year are expected from 2024 onwards.

Perspectives for 2023

The company’s liquidity and financial solvency are at a good level, thanks to the positive results achieved over the previous year. As a result we will propose to the AGM to distribute a substantial dividend from the 2022 profit (60-70% of the year’s profit). Considering that FORT is a company that we expect to generate consistently positive operating cash-flow, we will suggest a dividend policy of at least 50% of annual profit upon listing.

We have started the process of selecting the broker to assist us in the listing process, together with our partners at Agista. We expect to finalize the broker selection in Q1 2023, and we are targeting a listing either in June-July 2023 or in September-October, depending on the market context and broker feedback (or Hidroelectrica listing).

Approximate budget 2023

The 2023 budget will be presented and submitted to you, the shareholders, for approval at the Annual General Meeting which we expect to be held in April, via the eVote system.

At the time of writing, the working draft of the 2023 budget looks as follows:

Swipe left to see the numbers |

2021 |

2022 |

2023 |

YoY |

|---|---|---|---|---|

| Income from contracts with customers | 10,491,822 |

15,048,523 |

19,667,877 |

31% |

| Cost of sales | -5,375,089 |

-9,305,767 |

-13,944,371 |

50% |

| Gross margin | 5,116,733 |

5,742,756 |

5,723,506 |

0% |

| Other incomes | 815,713 |

570,052 |

1,920,000 |

237% |

| Cost of sales/distribution | -42,588 |

-339,971 |

-564,451 |

66% |

| Administrative expenses | -1,808,449 |

-2,145,012 |

-1,968,298 |

-8% |

| of which amortization | -231,465 |

-253,454 |

-402,267 |

59% |

| EBIT | 4,081,409 |

3,827,825 |

4,708,490 |

23% |

| Rezultat one-off | 680 |

-151,175 |

— |

— |

| Profit operational (fara one-offs) | 3,401,379 |

3,979,000 |

4,708,490 |

18% |

| Rezultat financiar | -26,254 |

-11,769 |

-279,985 |

2279% |

| Profit brut | 4,055,155 |

3,816,056 |

4,428,505 |

16% |

| Impozit pe profit | -136,862 |

-195,441 |

-336,454 |

72% |

| Profit net, din care: | 3,918,293 |

3,620,615 |

4,092,051 |

13% |

Achieving financial and operational objectives can only be accomplished through an efficient and highly productive organisation. To this end, 2023 will focus on the full integration of the Global Resolution Experts and ISEC teams, a process that will start in 2022. In order to achieve excellence in terms of internal organisation, Fort also aims to complete the full integration of administrative workflows into the processes and systems provided by the group. This will create the conditions for cost reductions and a rapid, thorough and effective analysis of the company’s performance indicators.

Also, in 2023 we will intensify our business development efforts by identifying new customers, mainly for recurring services offered by FORT, such as penetration testing or cybersecurity consulting. The initiation of new collaborations will also be possible through the provision of innovative or niche services, such as securing “DevOps” activities or performing audits on cyber security and resilience for companies that are part of M&A processes. 2022 brought a number of new collaborations but, given the needs of customers, the growth potential is far from being reached.

In terms of the geographical location of our clients, we aim to test an international presence, being of interest to companies operating in the financial and information technology industries, targeting mainly markets in the DACH (Germany, Austria, Switzerland), France, UK and the United States. Initial collaborations will be achieved by outsourcing certain prospecting and sales sub-processes to local partners, with the step of opening local offices to be taken after validating the potential of each market.

Activity analysis

In the first half of 2023, Fort focused on strengthening its team of industry experts and growing and diversifying its revenue streams to ensure the company’s long-term growth strategy. All of this was reflected in H1 2023 on expenses related to cybersecurity project delivery processes:

- 8,839,637 ron revenue, 11% more than in H1 2022

- an operating profit of 1,263,424 RON

- expenses related to sales increased by 43%, due to the strengthening of the expert team and the increase in the volume of equipment and resold licenses

During the first half of the year, Fort continued its process of growth and diversification of the services offered to customers. A significant new addition to our portfolio is the completion of the steps towards the creation of a Security Operations Centre (SOC). This service enables real-time analysis of security alerts generated by our customers’ infrastructure. Through this center, we ensure fast and efficient management of potential cyber security incidents. The product was developed as a result of our practical experience in identifying security vulnerabilities (pentesting) and managing security incidents. It comes as an additional and objective layer in managing the attack surface of our customers’ infrastructure.

We plan to start by offering it to existing customers, whose needs we know very well. We have already started the first discussions and negotiations in this regard and we are happy to announce that we have successfully completed the POC (Proof of Concept) and demonstrated the feasibility and coherence of our solution.

A very important element to mention is the signing of the first contract for the delivery of cybersecurity services in a “managed security services” regime. Through this type of collaboration, Fort purchases the licenses and security equipment required for the project and offers them as a service to the end customer, “bundled” with its own installation, configuration and maintenance activities – in the form of a monthly subscription. This contract has a duration of 36 months and represents a significant step in increasing the share of recurring revenue in the company’s turnover.

International expansion continues to be a central element of our development strategy. In the first half of the year, we organised more than 20 meetings to present FORT services to companies outside Romania, two of which generated concrete opportunities for collaboration. Our efforts in this direction will continue in the second half of the year, with the assessment of expansion opportunities in both the United States and South East Asia.

In the first six months, we signed collaborations with 5 new customers, who chose to entrust FORT with multiple operational aspects related to cybersecurity.

The partnership with KnowBe4 has evolved naturally as a complement to the services we provide, with a focus on improving the IT governance maturity of our clients. This collaboration allows us to add an extra layer of control to the awareness training process that our partners have implemented. In this context, we have initiated promotional campaigns in collaboration with KnowBe4, to increase awareness of the benefits that can be obtained by using the service. We can confirm that we have a stream of interested potential customers with whom we have already started detailed discussions on the implementation of this solution. The mentioned prospects are mainly medium and large companies in Romania.

At the same time, innovation remains a key focus for the company.

In 2022, we initiated a project co-financed by European Funds, called InsureAI. This project aims to develop and implement an innovative solution based on artificial intelligence in the insurance sector. Even though cybersecurity is only a tangential component in this project, FORT’s involvement was made possible by the long-term collaborations the company has had in the insurance industry. The end result of this project will be our company’s intellectual property and the culmination of over 8 years of experience in the insurance industry. The project is of particular importance in terms of optimizing the analysis and settlement processes for automotive damages. The solution developed as part of the project will provide users with the ability to automatically identify damaged elements of a vehicle and generate forecasts of estimated repair costs.

In H1 a first version of the full prediction algorithms that will be used in the final version of the application was released. The tests performed on the developed functionalities indicated a degree of accuracy that allows the use of the solution, but needs further improvements. In the next period, we will complete the research process and move on to the creation of the final software product.

The financial impact of the project in the first 6 months of this year is – 319,272 RON, and we maintain our target of -850,000 RON until the end of the year. The goal is for this project to generate revenues of 250,000 RON in 2024. The particular specificity of our company’s activity, namely in the field of services and without financial debt, ensures that we convert the overwhelming proportion of operating profit into net profit, which can also be translated into the premise of providing dividends to shareholders.

The availability of human resources continues to be the biggest brake on our accelerated growth ambitions. We have started in April 2023 an extensive recruitment process for the company’s sales activity. The results of these actions are expected to be visible in Q4 2023 and Q1 2024.

Swipe left to see the numbers |

Fort H1 '22 |

Fort H1 '23 |

Proiect InsureAI |

H1 '23vs H1 '22 |

|---|---|---|---|---|

| Income from contracts with customers | 7,928,016 |

8,839,637 |

0 |

11% |

| Cost of sales | -4,369,197 |

-6,281,673 |

-1,493,003 |

43% |

| Tehnical team | -2,145,149 |

-2,157,096 |

-1,493,003 |

— |

| Gross margin | 3,558,819 |

2,557,964 |

-1,493,003 |

-28% |

| Other incomes | 14,018 |

1,305,341 |

1,294,083 |

9212% |

| Cost of sales/distribution | -143,987 |

-292,022 |

-2,969 |

103% |

| Administrative expenses | -849,068 |

-1,279,284 |

-89,461 |

51% |

| of which amortization | -90,416 |

-177,787 |

-27,923 |

96% |

| Operating profit | 2,579,782 |

1,263,424 |

-319,272 |

-51% |

| Financial result | -13,929 |

-76,322 |

— |

— |

| Gross profit | 2,565,853 |

1,187,102 |

-319,272 |

-53% |

| Income tax | -290,635 |

-129,410 |

— |

-55% |

| Net profit | 2,275,218 |

1,057,692 |

-319,272 |

-53% |

The 11% increase in turnover compared to the first half of 2022 cannot be considered spectacular, but it represents a positive trend that we are committed to maintain until the end of the year.

This was influenced by two major elements:

The start of the “managed services” mode of offering services leads to a decrease in turnover in the short term, in return for providing recurring revenues.

A number of projects have been postponed to the third and fourth quarters, which has had a negative impact on the company’s financial situation in the profit and loss report for the first six months. However, we expect this situation to lead to better results in the second half of the year compared to the same period of 2022.

Plans for the end of the year:

- Increase turnover: We aim to continue the positive trend and to record an increase in turnover of at least 25% compared to the same period last year.

- International Expansion: We will continue to explore and expand our presence in international markets, aiming to sign collaborations with at least 3 customers outside Romania.

- Implementation of deferred projects: We will focus on the implementation of deferred projects in the first 6 months of the year, with the aim of bringing positive results in Q3 and Q4.

- Investment in sales pipeline development: We will allocate significant resources to develop a robust pipeline of sales opportunities to support planned revenue growth. We already have partnerships in place to do this.

- Maintain the share of services at around 60% of turnover.

- Increase the share of recurring services to around 50% by year end through the sale of managed services and SOC subscriptions.

These relevant targets will guide the company’s efforts in the coming months, helping to grow and strengthen its market position.

Message from the CEO

In the context of Fort’s development, the keywords defining the direction and objectives for the second half of the year are “growth” and “diversification”. These two fundamental concepts are rooted in our strategic vision to strengthen our position in the cybersecurity services market and to bring increased value to the customers and partners we are pleased to work with.

“Growth” means continuing our efforts to expand our market impact and presence. This objective involves not only increasing turnover, but also the constant development of the customer portfolio and the various market segments.

We are looking at a very promising sales pipeline, which includes potential projects worth a total of around €2 million. These projects are distributed between “One Off” deliveries, i.e. one-off projects, and recurring contracts, which we anticipate will generate revenue for periods between 1 and 3 years.

We are stepping up our commitment to continued investment in sales and marketing activities, both in Romania and internationally, with a view to generating projects for the fourth quarter of 2023 and the full year 2024. In the process, we aim to significantly improve the sales channels through which we promote the company’s services. Our firm goal is to conclude collaborations in 2023 with at least 7 new customers, of which at least 3 should be from outside Romania.

“Diversification” reflects our desire to bring a wide range of innovative options and services to the portfolio. We understand that customer requirements are complex and varied, so we focus on developing a set of offerings that cover a wide range of needs and situations.

We plan to invest in expanding our cybersecurity portfolio, with a focus on managed services activities and by establishing multiple partnerships with cybersecurity-specific technology providers. At the same time, we continue to invest in growing our internal teams so that we can deliver complex projects in the company’s “classic” activities such as penetration testing, auditing and consulting.

Last but not least, for the second half of 2023, we plan to build relationships with more new customers by adding Security Operations Center (SOC) subscriptions to the Fort portfolio.

It’s true that the cybersecurity market is diverse and fragmented, and the BIG 4 (the world’s largest consulting and professional services firms) may have resources and reputations we can’t match. However, there are many other large and small companies as well as independent professionals that play a significant role in the cybersecurity industry. Here are a few of these categories:

- Large cybersecurity companies: In addition to the BIG 4, there are many other companies that specialize in cybersecurity. Here we consider them to be our main competitors.

- Small companies and start-ups: In recent years, many start-ups have emerged offering innovative cybersecurity solutions. These companies often focus on smaller market segments or specific technologies and may have greater agility and flexibility in developing and implementing security solutions.

- Freelancers and independent consultants: Independent cybersecurity professionals can provide specialized services such as penetration testing, security consulting or risk analysis. They can be hired by organizations for specific projects or to complement the capabilities of their in-house team.

- IT integrators: Some integration companies also offer cybersecurity services as part of their portfolio. They can integrate security solutions into their customers’ IT infrastructure and provide security management services.

- Managed Security Service Providers (MSSPs): These companies specialize in providing managed cybersecurity services, allowing customers to outsource the monitoring and management of their security.

The fragmentation of this market offers a wide range of options for organizations seeking cybersecurity services and solutions.

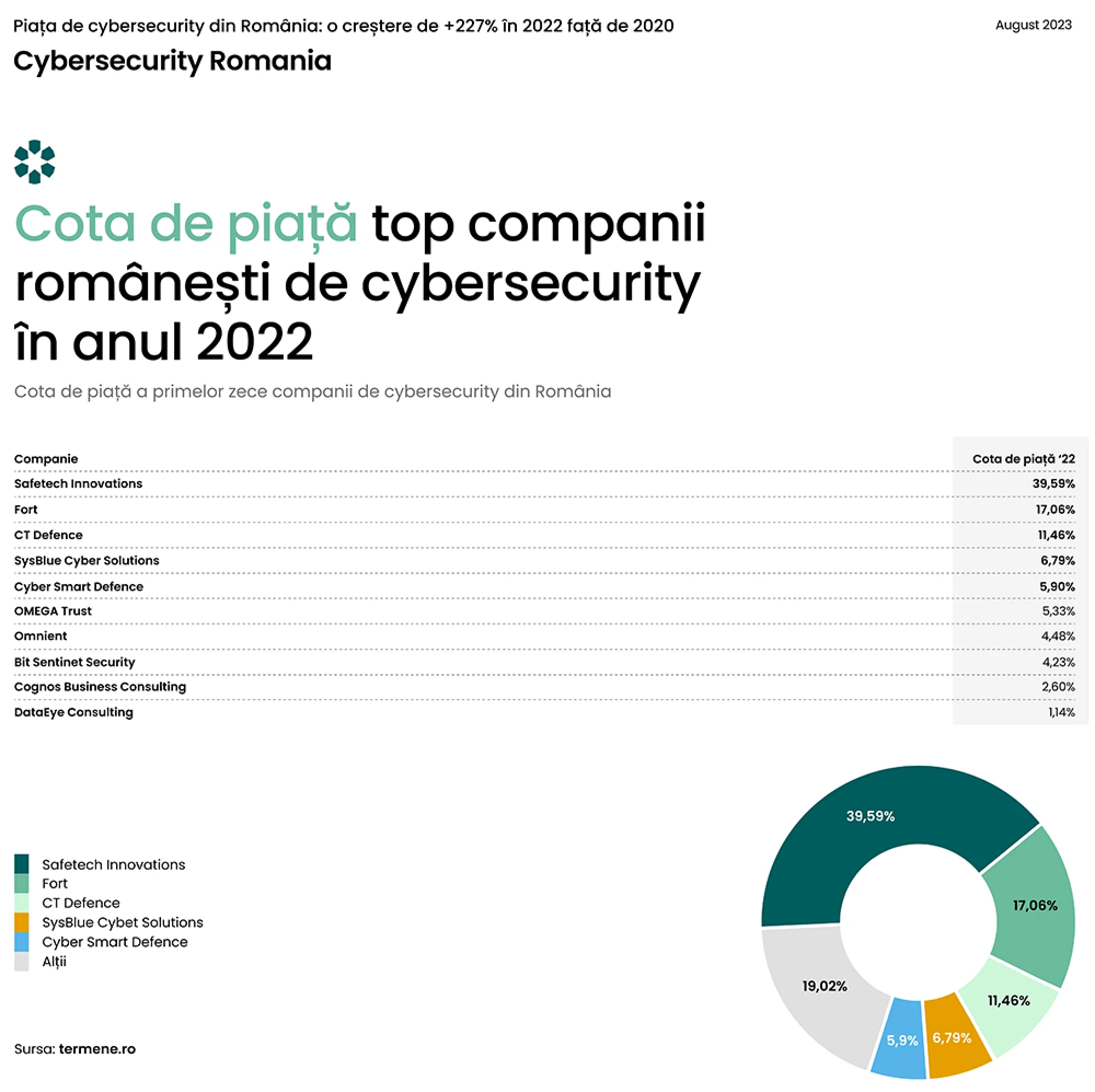

We mention that we have included in the analysis only companies that provide exclusively cybersecurity services (pentest, audit, consulting) and excluded BIG4, due to its extensive consulting portfolio.

Our Promise

When you partner with FORT, you’re not just getting a service provider—you’re gaining a trusted ally committed to your cybersecurity journey. We’ll be there through evolving threats, changing compliance landscapes, and your organization’s growth, ensuring your digital foundation remains unshakable.

Together, let’s build security that enables rather than restricts, that empowers rather than intimidates, and that protects without getting in the way of progress.

Welcome to FORT—where security meets simplicity

- Iulian Stoica